B2B Wins #42: Stacking Yeses

Venture investors want to say "No". Give them a reason to say "Yes".

Welcome to 2025! After a holiday hiatus, B2B Wins is back! I’ll continue to focus on the challenges of early-stage startups primarily in the B2B space.

As one would expect, of the many concerns that founders have during the early-stage, cash flow continues to be the primary concern. Sure, you want to make a great product, but cash is oxygen.

Last year’s fundraising numbers aren’t out yet but I predict they’re going to be very soft. At best, roughly equivalent to 2023. Unless you were a marquis player in the AI industry, 2024 was a hard year to raise money.

So what will it take in 2025 to raise money. Part of this is out of your control. It’s going to take some normalization in the market to unlock some of the cash that’s been sitting on the sidelines.

What is in your control is to have an awesome story to tell and telling that story well.

Frameworks are not Storytelling

As I’ve mentioned in the past, raising money is all about effective storytelling even if you’re Sam Altman. We’re all familiar with the common frameworks for pitch decks, but a framework is not a story.

Let’s linger on that a moment: A framework is not a story.

If you think about a graphic novel (or a comic book for those with more grey in their beards), the framework is simply the pages in the book. Frameworks tell you how to structure the story.

What’s in each frame of the page is what counts. The things in the frame tell the story. So, of course you should a framework. That’s just the beginning of building a story.

So what are you putting in those frames? It starts with your reader.

Your Unique Audience

Before you can build a story, you have to know who you’re writing it for. A children’s book author thinks differently about storytelling than a young adult writer and certainly differently than a romance novelist.

Investors are your unique audience. So what are some of their characteristics?

They have a thesis. They believe they know what kinds of businesses they can evaluate for themselves and their limited partners. You have to be in their thesis.

The follow the crowd. None of them want to be first. They want to invest in ideas that are aligned with the big trends. You can’t be an outlier from the big trends.

They’re professional skeptics. They are looking for reasons to say “No!”

That last point is perhaps the most important.

Investors see around a thousand decks a year. They’re going to make 5-10 investments. They don’t evaluate each deck trying to figure out if “this is the one!” It’s far easier to dismiss a deck, to find a reason to say “No”, than it is to synthesize a yes.

The best investors do this very quickly. When I was raising a seed round, I used DocSend to distribute my decks. One of the features I love about DocSend is that it shows you how each investor went through the deck. Where they spent time, where they didn’t.

Here’s the hard reality of pitch decks:

Investors spend two minutes with your deck.

Most of that time is on the first 2-3 pages.

Then they’re out.

Those first couple of pages have to get their attention so that they’ll either: 1) spend a little more time understanding your story and/or 2) invite you for a meeting.

Stacking Yeses.

So how do you avoid the “No.”. You stack Yeses.

When an investor reads your deck you have to put off the “No” for as long as possible. If you’re lucky, that “No”—your bogus financial projections or sloppy market analysis—will never be seen because you got enough Yeses in the front of the deck that they don’t even read that far. They just invite you to a meeting.

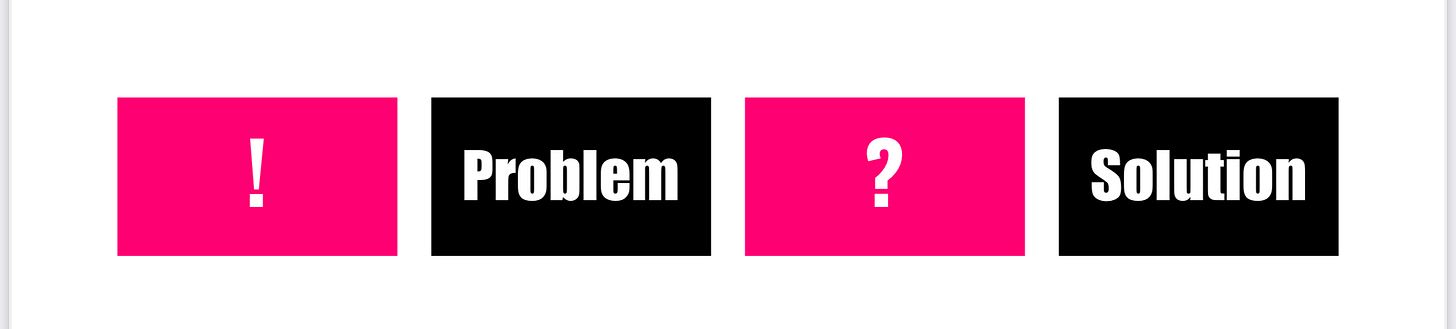

What does stacking Yeses look like? The good news is that Michael Ho has developed a framework in which you can tell a “Yes” story. Instead of starting your deck with the traditional Problem-Solution slide set—both these slides are the source of the vast majority of “Noes”—he suggests adding two slides to enhance the storytelling and get you a few yeses in those early charts.

The two new slides are:

The “Big Change” or the situation that we can all agree upon. Your first “Yes”.

The “What If” an idealized state that describes a future world where the problem doesn’t exist. Another “Yes”.

Here is that framework in sequence.

Something has changed that we can all agree on.

That change has created a problem - this is your traditional problem chart. If you get the “yes” to the first chart, you’re more likely to avoid the “No” here.

But what if a world existed where that problem, wasn’t a problem. I think we can all agree that would be good.

Here’s the solution that gets us there - this is your traditional solution chart. If this delivers the promised world then you’re going to avoid another “No”.

Here’s an example that Michael built to demonstrate the framework applied to Dropbox.

This type of story feels very satisfying because you’re using both an emotional and an intellectual approach to the storytelling.

Find your yeses and you’ll get more meetings. You may even find a better business idea because the first person you have to convince is yourself. If you can’t build a great story that you believe, maybe you have to look at your idea.

Storytelling is not design

I often encounter founders who need their deck “designed”. When I think about deck design I think about how to make a great story look good. It’s about fonts and graphics. “Look and feel”.

Yes, you want a design that supports your story. If you market is fantastical, like gaming, make the deck design fantastical. If you’re in a more sober industry like fintech, then a more sober design may be necessary. Don’t take my word for it, talk to a designer.

My point is this, a great design will not fix a crappy story. Investor’s radar is tuned to detect crappy stories. Your design won’t help.

Your goal is to write an awesome story in a familiar framework and then have a designer elevate that story to the next level. All of this stacks up enough yeses to get you that first meeting.